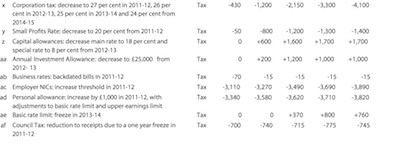

While the Conservative – Liberal Democrat coalition have cut the headline rate of corporation tax in the UK since coming to power in 2010 their inconsistent approach to providing companies tax incentives to re-invest have resulted in wild fluctuations in companies’ tax bills during their time in power.

Initially slashing incentives to re-invest resulted in companies paying additional taxes despite the headline rate dropping. Latterly, for two years from January 2013, the Government have dramatically reversed their policy of reducing incentives to re-invest, increasing the amount companies can spend on assets and offset completely against corporation tax by ten-fold.

I think this latest change in policy is excellent, but think the Government ought to have been encouraging companies, particularly smaller companies, to re-invest from the time they came into power.

I think the changes to tax incentives for reinvestment were a mistake akin to the mistake made by Gordon Brown when he abolished the 10% starting rate of income tax. The reversal of the current government’s position has not attracted as much media attention as the abolition of the 10% starting rate of income tax; presumably because the impact on individuals is harder to pin down and less direct. I think though the current government’s record shows it initially failed to support, particularly smaller, growing, companies through the tax system despite a policy of promoting business as the driver of economic growth.

In the 2007 Budget Gordon Brown’s New Labour Government abolished the 10% starting rate of income tax. The abolition increased the tax burden, disproportionally impacting the lowest paid.

Brown has since admitted that was a mistake. To me it showed that Brown and others involved in the decision didn’t understand what they were doing and failed to appreciate the impact of their decision on those who elected them. As Labour party politicians I would have expected them to act in the interests of low paid workers. That their actions when against their beliefs suggests to me they didn’t understand the consequences of the decisions they were being asked to make.

The changes the Conservative – Liberal Democrat coalition have made to corporation tax since coming into power in 2010 appear to me to show a similar lack of understanding.

The coalition have been reducing the main rate of corporation tax. It was 28% in 2010, 26% in 2011 and it will be 21% in 2014/15.

In 2010 the chancellor, George Osbourne stated:

I want a sign to go up over the British economy that says “Open for business”, and this is how I propose to do it. Corporation tax rates are compared around the world, and low rates act as adverts for the countries that introduce them. Our current rate of 28p is looking less and less competitive, so we will do something about it.

In the March 2011 budget (the new Government’s first full budget) while the headline rate of corporation tax was cut, the Government actually took more tax from companies as they removed incentives for companies to invest in new equipment and other assets from the tax system.

The corporation tax tax cut was projected to save companies £0.4bn in 2011-12 rising to £1bn in 2014/15. However the amount of investment companies were permitted to offset entirely against their profits for corporation tax purposes was slashed from £100,000 to £25,000 which was expected to cost companies £1.2bn in 2013-14 and £1bn in 2014-15 and the year after that.

In addition the tax reducing effect of on investment above the level of the 100% allowance was also slashed; as capital allowances were decreased from 18% to 8% costing companies an additional £1.6-1.7bn from 2013.

The government made it more attractive for companies to amass profits, and less attractive for them to re-invest in things which could make their operations more successful. My view is the incentives were in the wrong place.

While as yet the chancellor George Osbourne hasn’t admitted his approach was a mistake; he has at least reversed some of the disincentives to re-investment which he introduced.

The 2013 budget increased the amount spent purchasing assets which companies can deduct from their profits before calculating their liability to income tax from £25,000 to £250,000 for two years. The Government expects this to reduce the tax take from companies by around £1bn/year during the time it is in operation.

My view is these changes over the period of the last few years have amounted to wild lurches in the tax system, making the UK a less predicable place to run a company than it otherwise would have been.

I think we’ve seen the Conservative chancellor doing exactly what Labour’s Gordon Brown did, making a change which went against his core principles, presumably through a lack of understanding of its impact.

3 responses to “Wild Fluctuations in Tax Incentives for Companies to Invest – A Mistake Akin to Abolishing the 10 Percent Income Tax Rate”

“increasing the amount companies can spend on assets and offset completely against corporation tax by ten-fold.”

Ten-fold over what they had slashed it to! Only 2.5x what it was before they cut it, which was £100,000.

Most sorts of capital expenditure are deductible anyway, it’s just over time. Those that aren’t can’t be set against the Annual Investment Allance anyway. The AIA helps cash flow by reducing your tax bill now rather than a little bit every year for ten years, for example. Which may or may not be an issue for a company. But one of the big benefits was that you then didn’t have to do the assessment on what rate to capitalise at, and do the calculations on your asset pool etc. That was the madness of slashing it – for a red-tape decrying government they massively increased the pain of declaring investment of trivial sums of money.

One thing that hasn’t been mentioned much: the rate of tax paid by small companies was already 20%. The government hasn’t reduced it: the large company and small company rates are converging. Which might simplify things for the few companies that transition between the rates, but does bugger-all to benefit those paying the small companies rate. It’s about big business.

THAT IS GOOD

MU88 – Link vào nhà cái uy tín mới nhất https://mu88.express

MU88 – Thiên đường giải trí với hàng ngàn slot game, mini game hấp dẫn. Nạp rút nhanh chóng, bảo mật cao và khuyến mãi khủng mỗi ngày.